This guide explains IRS Form 6765 instructions so you can accurately claim the R&D tax credit, understand eligibility, calculate credits, and meet recordkeeping standards for 2025 filings.

At BooksMerge, we help businesses navigate complex tax forms with confidence. This clear walk‑through of IRS Form 6765 instructions shows you how to file the form correctly, claim valuable tax credits, and understand the rules with real IRS sourced content and trusted details. You can reach us at +1‑866‑513‑4656 if you need personalized support throughout the process.

What is Form 6765 Used For?

Form 6765 is the IRS form used to calculate and claim the Credit for Increasing Research Activities (often called the R&D tax credit). Following the Form 6765 Instructions carefully ensures you claim the credit correctly and maximize your benefits. This powerful incentive can reduce your income tax or, for eligible small businesses, even your payroll tax.

If you perform qualifying research in the U.S., this form might unlock serious savings.

Who Qualifies for R&D Tax Credit?

The R&D tax credit isn’t limited to labs and programmers. Many companies across industries qualify when they:

- Innovate products, processes, or software

- Improve existing products or systems

- Conduct experiments with technical uncertainty

To qualify, research must meet four IRS criteria including scientific or technical uncertainty and a process of experimentation. Eligible entities include corporations, partnerships, and sole proprietorships.

Small businesses with gross receipts under certain thresholds may also elect to use the credit against payroll taxes.

What Are QREs?

Qualified Research Expenses (QREs) are the costs used to figure your research credit on Form 6765. These typically include:

- Wages of employees performing qualified research

- Supplies used in research

- Contract research expenses

- Rental or lease costs of computers used in research (under specific rules)

The IRS requires careful tracking of QREs. Total QREs go on Section F of the form, which feeds into your credit calculation.

Step‑by‑Step Instructions for Form 6765

These IRS Form 6765 instructions help you complete each section accurately.

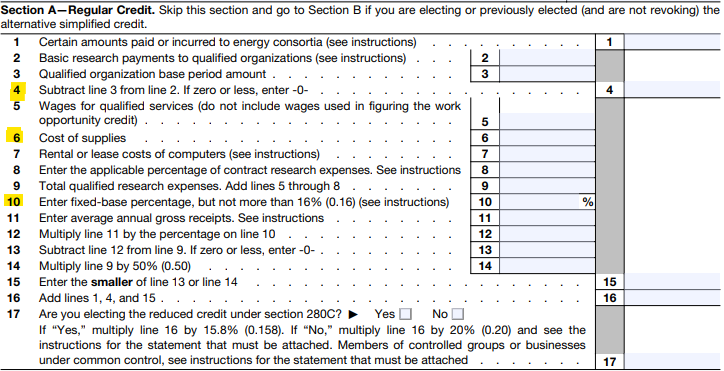

Section A: Regular Credit

Choose the regular credit if you want to compute the full credit based on your historical research expenses and base period. This involves calculating:

- Base amount tied to past research

- Current QREs

- Your allowable credit

This method often gives a higher credit but is more complex.

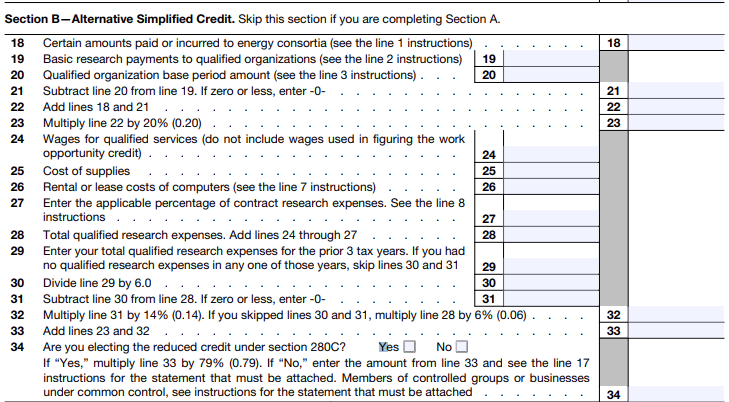

Section B: Alternative Simplified Credit (ASC)

You may elect the Alternative Simplified Credit if you prefer a smoother computation. It uses your past 3 years of QREs as a benchmark to calculate a percentage that determines your credit.

How to calculate ASC vs regular method:

- Regular method: Uses a detailed base amount from years further back

- ASC: Uses average QREs from the last 3 years, often easier to compute

Choosing between them depends on past research patterns and which produces a higher credit for your situation.

Section C: Current Year Credit

Section C totals the credit you’ve figured and feeds it into the tax return. Don’t worry if this sounds technical — preparing Section A or B correctly flows smoothly into Section C calculations.

Section D: Qualified Small Business Payroll Tax Election

One of the exciting parts of Form 6765 is the payroll tax credit election for eligible small businesses. Qualified small business filers can elect to use up to $500,000 of the credit against the employer portion of Social Security payroll taxes.

This option is extremely helpful for startups or companies without significant income tax burden.

Quick Tip: Double-check your personal info, income entries, and deductions when filling out Form 1040 to avoid errors and speed up your tax refund.

What Documents Are Required?

To file Form 6765 correctly, you need supporting documentation including:

- Payroll records showing qualified wages

- Invoices or receipts for supplies used in research

- Contracts for outsourced research

- Time tracking for research activities

You don’t attach all backup to the IRS, but you must retain these records in case of review. The IRS has clear documentation expectations for validating the credit.

Can Startups Use Payroll Offset?

Yes. Qualified small businesses, including many startups, can use a portion of their R&D credit to offset payroll taxes. This is especially helpful for early stage firms without large income tax liabilities.

This option applies for up to five tax years beginning with the first year the credit is available, subject to conditions.

What Changed in 2025?

The 2025 version of the instructions includes important updates:

- New Section E and G for additional reporting details.

- Payroll credit election rules clarified.

- Controlled group reporting requirements are updated.

The IRS continues to seek feedback on the draft instructions, and businesses should watch for revised guidance in early 2026.

Best Practices and Tips for Filing Success

Follow these practical steps to improve accuracy and reduce audit risk:

1. Organize Expenses:

Keep records by category (wages, supplies, contracts).

2. Track R&D Activities:

Document what was done, who did it, and what was learned.

3. Use Reliable Payroll Reports:

Make sure wage reports include research time.

4. Attach Required Schedules:

If you answer “Yes” to controlled group questions, include a detailed attachment.

5. Consult Experts:

A CPA or tax pro can help you maximize credits and avoid costly mistakes.

Also, don’t miss insights on small business financial literacy and R&D planning available at this link: https://www.booksmerge.com/blog/small-business-financial-literacy-stats/ — it’s a valuable resource that connects credit planning with broader financial health.

Conclusion

Understanding IRS Form 6765 instructions isn’t just about filling a tax form. It’s about unlocking a valuable credit that rewards innovation. Whether you are a startup, small business, or established company, reading and following the IRS guidance carefully helps you claim every dollar you deserve.

Accurate filing strengthens compliance and lowers audit risk. If this feels overwhelming, BooksMerge can help you every step of the way. Call +1‑866‑513‑4656 for support.

Frequently Asked Questions

What is Form 6765 used for?

It is used to calculate and claim the federal credit for increasing research activities.

Who qualifies for R&D tax credit?

Companies conducting qualified research and incurring QREs typically qualify under IRS criteria.

What are QREs?

Qualified Research Expenses include wages, supplies, contract research, and certain computer rental costs used in research.

How to calculate ASC vs regular method?

ASC uses recent QRE averages and is simpler; the regular method uses a historical base period. The better method depends on your expense history.

What documents are required?

Retain payroll, invoices, contracts, and research documentation. You do not send everything with your return but must have records.

Can startups use payroll offset?

Yes. Qualified small businesses may elect to use up to $500,000 of credit against payroll taxes.

What changed in 2025?

New sections and reporting requirements were added to the instructions, including updates to Section E and G.

If you want help preparing Form 6765 or related tax planning, reach out to BooksMerge experts at +1‑866‑513‑4656. We make tax credits work for your business without stress.

Read Also: IRS form list